All Categories

Featured

Table of Contents

That usually makes them an extra affordable option forever insurance protection. Some term policies may not maintain the premium and death benefit the exact same over time. Level term life insurance. You do not wish to incorrectly assume you're buying degree term insurance coverage and afterwards have your survivor benefit modification later. Many people obtain life insurance policy coverage to help financially secure their enjoyed ones in instance of their unforeseen death.

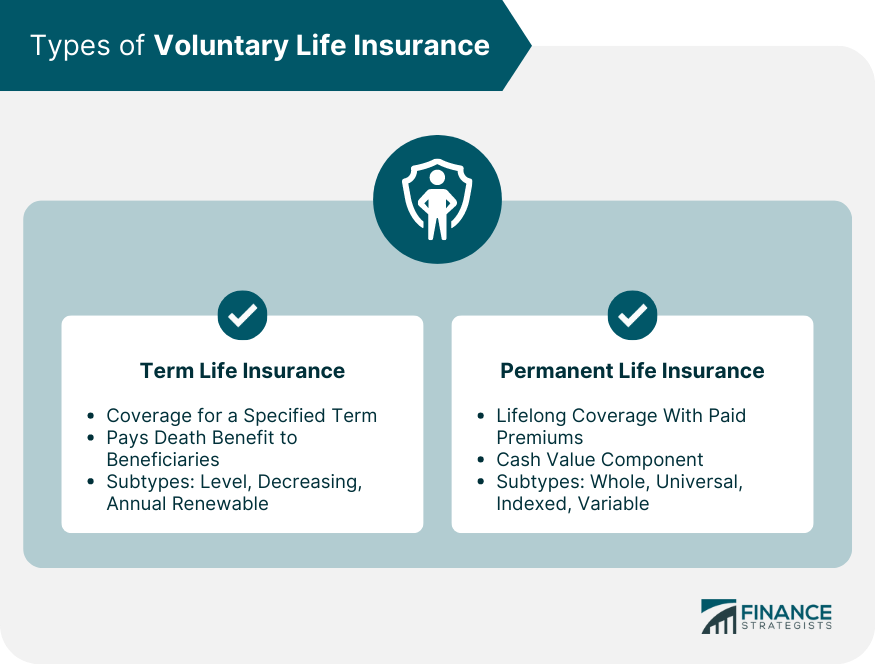

Or you may have the choice to transform your existing term insurance coverage right into an irreversible plan that lasts the rest of your life. Numerous life insurance plans have potential advantages and disadvantages, so it's vital to recognize each before you make a decision to acquire a plan.

As long as you pay the premium, your beneficiaries will obtain the survivor benefit if you die while covered. That said, it is essential to note that many policies are contestable for two years which implies coverage could be retracted on fatality, should a misstatement be located in the application. Plans that are not contestable typically have actually a graded fatality benefit.

What is Simplified Term Life Insurance? Pros and Cons

Premiums are normally less than entire life policies. With a degree term policy, you can choose your coverage amount and the policy size. You're not locked right into an agreement for the rest of your life. Throughout your plan, you never ever have to fret about the premium or death benefit amounts changing.

And you can not cash out your plan throughout its term, so you won't receive any type of financial take advantage of your past insurance coverage. As with various other kinds of life insurance coverage, the cost of a degree term policy relies on your age, protection needs, employment, way of life and health and wellness. Normally, you'll discover extra cost effective insurance coverage if you're more youthful, healthier and less high-risk to guarantee.

Since degree term premiums stay the same throughout of coverage, you'll know exactly just how much you'll pay each time. That can be a huge aid when budgeting your costs. Degree term protection additionally has some adaptability, permitting you to tailor your policy with additional functions. These often been available in the kind of riders.

How Does Term Life Insurance For Spouse Keep You Protected?

You may have to meet certain problems and credentials for your insurance provider to pass this biker. There also could be an age or time restriction on the coverage.

The survivor benefit is usually smaller, and coverage normally lasts up until your kid transforms 18 or 25. This cyclist may be a more cost-efficient way to aid ensure your children are covered as riders can frequently cover numerous dependents at when. Once your kid ages out of this insurance coverage, it may be feasible to transform the biker into a brand-new policy.

The most typical kind of long-term life insurance policy is entire life insurance coverage, however it has some crucial distinctions compared to level term insurance coverage. Here's a standard summary of what to take into consideration when comparing term vs.

Is 30-year Level Term Life Insurance Right for You?

Whole life insurance lasts insurance coverage life, while term coverage lasts for a specific periodDetails The premiums for term life insurance policy are commonly lower than entire life protection.

One of the main functions of degree term protection is that your costs and your death benefit don't alter. With reducing term life insurance policy, your costs continue to be the exact same; nonetheless, the survivor benefit quantity obtains smaller in time. You may have protection that begins with a death benefit of $10,000, which might cover a home mortgage, and after that each year, the death advantage will decrease by a collection quantity or percent.

As a result of this, it's often a much more inexpensive type of level term protection. You might have life insurance coverage via your company, yet it may not be enough life insurance for your demands. The very first action when purchasing a policy is figuring out how much life insurance policy you require. Take into consideration variables such as: Age Family members dimension and ages Work condition Income Debt Way of life Expected last costs A life insurance coverage calculator can aid establish just how much you need to start.

What is the Role of Decreasing Term Life Insurance?

After making a decision on a policy, complete the application. For the underwriting procedure, you might have to provide basic individual, health and wellness, lifestyle and work details. Your insurance firm will figure out if you are insurable and the threat you might provide to them, which is mirrored in your premium prices. If you're authorized, authorize the paperwork and pay your very first premium.

Think about scheduling time each year to examine your plan. You may desire to upgrade your beneficiary information if you have actually had any kind of considerable life adjustments, such as a marriage, birth or separation. Life insurance coverage can in some cases really feel challenging. You don't have to go it alone. As you discover your options, take into consideration discussing your demands, desires and worries about a financial professional.

No, degree term life insurance policy does not have money value. Some life insurance policy policies have a financial investment function that allows you to develop money worth in time. A portion of your premium repayments is reserved and can gain interest over time, which expands tax-deferred throughout the life of your protection.

You have some alternatives if you still desire some life insurance policy protection. You can: If you're 65 and your protection has actually run out, for instance, you might desire to buy a brand-new 10-year level term life insurance policy.

What is the Advantage of What Is Direct Term Life Insurance?

You might have the ability to transform your term insurance coverage right into an entire life plan that will certainly last for the rest of your life. Lots of types of degree term policies are convertible. That implies, at the end of your insurance coverage, you can transform some or every one of your policy to entire life insurance coverage.

A degree premium term life insurance coverage strategy allows you stick to your spending plan while you aid protect your family. ___ Aon Insurance Solutions is the brand name for the brokerage and program management operations of Fondness Insurance policy Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Policy Firm, Inc. (CA 0795465); in OK, AIS Fondness Insurance Coverage Services Inc.; in CA, Aon Affinity Insurance Policy Providers, Inc .

Latest Posts

Instant Issue Term Life Insurance

Final Benefits Insurance

No Exam Instant Life Insurance