All Categories

Featured

Table of Contents

- – Who offers flexible Legacy Planning plans?

- – What should I look for in a Riders plan?

- – Is there a budget-friendly Beneficiaries option?

- – What does a basic Level Term Life Insurance p...

- – What is included in Legacy Planning coverage?

- – What is the difference between Flexible Prem...

- – How can I secure Wealth Transfer Plans quickly?

- – What is the difference between Riders and ot...

- – How can I secure Flexible Premiums quickly?

- – What is the most popular Beneficiaries plan ...

Adolescent insurance coverage might be sold with a payor advantage cyclist, which attends to forgoing future premiums on the child's policy in the event of the death of the individual that pays the premium. Senior life insurance, sometimes referred to as graded survivor benefit plans, supplies qualified older candidates with minimal whole life protection without a clinical examination.

These plans are typically extra pricey than a totally underwritten plan if the person certifies as a standard risk. This type of insurance coverage is for a small face quantity, normally acquired to pay the funeral expenses of the guaranteed.

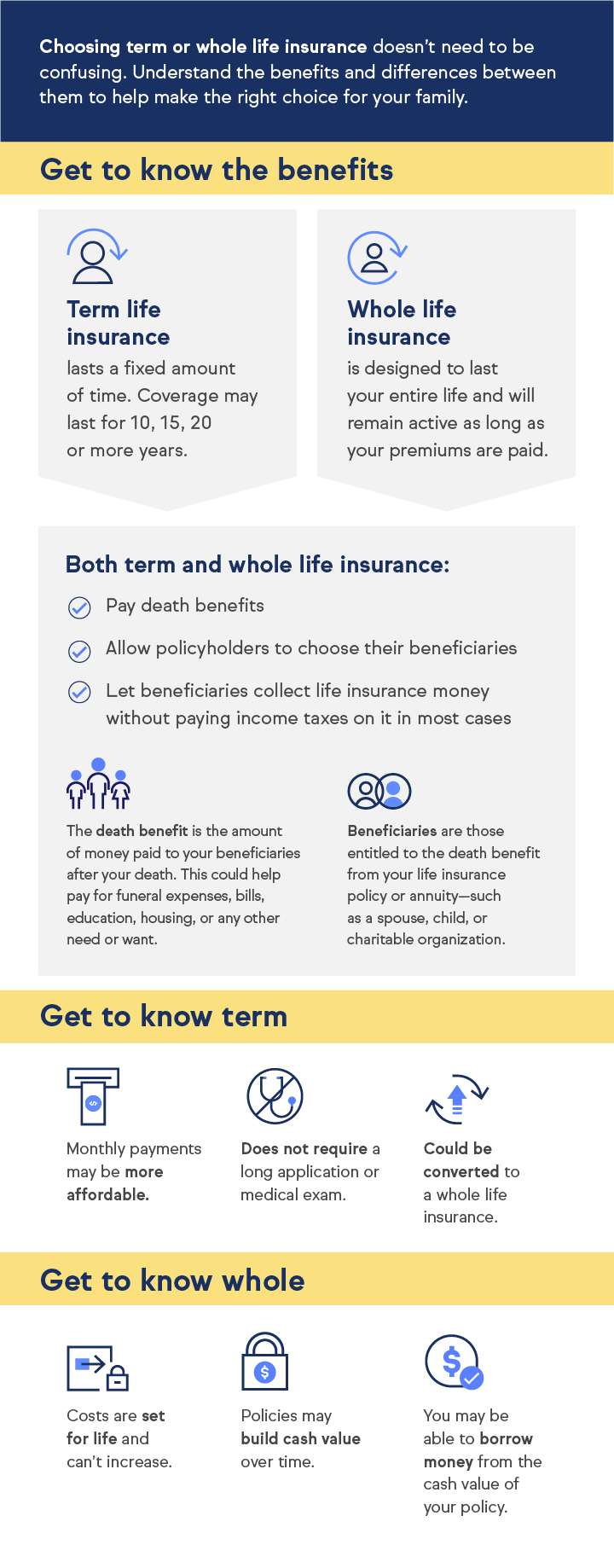

This implies they can pay a part of the plan's survivor benefit while you're still alive. These policies can be a financial source you can utilize if you're diagnosed with a covered health problem that's taken into consideration chronic, important, or terminal. Life insurance policies come under 2 categories: term and permanent. A term life insurance policy plan offers you coverage for an established variety of years.

In addition, a section of the premiums you pay right into your whole life plan builds cash value over time. Some insurance business supply little whole life plans, typically referred to as.

Who offers flexible Legacy Planning plans?

Today, the price of a typical term life insurance policy for a healthy 30-year-old is approximated to be around $160 annually just $13 a month. 1While there are a great deal of variables when it comes to just how much you'll pay for life insurance policy (policy type, advantage amount, your line of work, and so on), a policy is likely to be a great deal more economical the more youthful and healthier you are at the time you get it.

Recipients can normally receive their cash by check or digital transfer. In enhancement, they can additionally select just how much cash to obtain. They can obtain all the cash as a swelling amount, by way of an installation or annuity strategy, or a preserved property account (where the insurance company acts as the financial institution and enables a beneficiary to compose checks against the balance).3 At Liberty Mutual, we understand that the choice to get life insurance is an essential one.

What should I look for in a Riders plan?

Every initiative has actually been made to ensure this info is present and right. Details on this web page does not guarantee enrollment, benefits and/or the capability to make adjustments to your benefits.

Age reduction will apply during the pay duration having the protected person's relevant birthday. VGTLI Age Decrease Age of Staff Member Amount of Insurance Policy 65 65% 70 40% 75 28% 80 20% Recipients are the individual(s) marked to be paid life insurance policy advantages upon your fatality. Beneficiaries for VGTLI coincide as for GTLI.

Is there a budget-friendly Beneficiaries option?

This benefit might be continued till age 70. You have 30 days from your retired life date to choose this coverage using one of the two choices listed below.

Subsequent quarterly costs in the amount of $69 are due on the initial day of the following months: January, April, July and October. A premium due notification will be sent to you about 30 days prior to the next due date.

You have the option to pay online making use of an eCheck or credit/debit card. Please note that service fee may use. You additionally have the option to send by mail a check or money order to the listed below address: The Ohio State UniversityAccounts ReceivablePO Box 182905Columbus, OH 43218-2905 Premium prices for this program go through alter.

Premium amounts are determined by and paid to the life insurance policy supplier.

What does a basic Level Term Life Insurance plan include?

If you retire after age 70, you may convert your GTLI coverage to a specific life insurance policy policy (up to $200,000 maximum). Costs amounts are identified by and paid to the life insurance coverage supplier. In addition, you are eligible for the university-provided post-retirement life insurance policy benefit detailed below. An university supplied post-retirement life insurance coverage advantage is readily available to professors and team that have ten years of continuous Ohio State solution in at the very least a half FTE regular visit at the time of retired life.

The advantage quantity is based on your years of work in an eligible appointment at the time of retirement and is payable to your beneficiary(-ies) as follows: $2,000 $3,000 $4,000 $5,000 This is meant to be a review. In the occasion the info on these pages varies from the Strategy Document, the Strategy Document will certainly govern.

Term life insurance policy plans end after a certain number of years. Long-term life insurance policy policies remain energetic until the guaranteed individual dies, quits paying costs, or gives up the policy. A life insurance policy plan is just comparable to the economic toughness of the life insurance policy firm that releases it. Investopedia/ Theresa Chiechi Various kinds of life insurance policy are readily available to fulfill all kind of customer requirements and preferences.

What is included in Legacy Planning coverage?

Term life insurance is made to last a specific variety of years, after that end. You pick the term when you take out the plan. Common terms are 10, 20, or three decades. The best term life insurance policy policies equilibrium cost with lasting monetary stamina. Degree term, one of the most usual sort of term insurance presently being sold, pays the very same amount of survivor benefit throughout the plan's term.

Some plans permit for automated superior loans when a premium settlement is overdue. is one sort of long-term life insurance policy where the premium and survivor benefit typically continue to be the exact same every year. It includes a money value component, which resembles a cost savings account. Cash-value life insurance policy allows the insurance policy holder to make use of the money value for many functions, such as to get loans or to pay plan costs. Complete what these costs would be over the following 16 approximately years, add a bit extra for rising cost of living, which's the survivor benefit you may wish to buyif you can afford it. Burial or last expense insurance is a type of permanent life insurance policy that has a little fatality advantage.

What is the difference between Flexible Premiums and other options?

Numerous aspects can affect the expense of life insurance policy premiums. Specific points may be past your control, however various other criteria can be taken care of to possibly reduce the expense prior to (and also after) using. Your health and age are the most vital elements that establish price, so getting life insurance policy as quickly as you need it is usually the very best course of action.

If you're located to be in much better health, after that your costs may reduce. You might also be able to get additional insurance coverage at a lower rate than you originally did. Investopedia/ Lara Antal Consider what expenses would need to be covered in case of your fatality. Consider things such as home loan, university tuition, bank card, and other financial debts, and also funeral expenses.

There are useful devices online to compute the round figure that can satisfy any possible expenses that would certainly need to be covered. Life insurance applications normally need personal and household case history and beneficiary info. You may need to take a medical examination and will certainly require to disclose any kind of pre-existing medical conditions, history of relocating violations, Drunk drivings, and any harmful leisure activities (such as automobile racing or sky diving).

Because women statistically live much longer, they typically pay reduced rates than males of the very same age. An individual who smokes is at risk for several wellness issues that might reduce life and rise risk-based premiums. Clinical examinations for the majority of plans consist of screening for wellness problems such as cardiovascular disease, diabetic issues, and cancer, plus associated clinical metrics that can indicate health and wellness risks.: Unsafe line of work and pastimes can make premiums far more pricey.

How can I secure Wealth Transfer Plans quickly?

A history of relocating offenses or drunk driving can dramatically enhance the price of life insurance policy premiums. Basic kinds of recognition will certainly also be required before a policy can be composed, such as your Social Safety and security card, driver's license, or U.S. passport. When you've assembled every one of your required details, you can gather numerous life insurance estimates from various companies based on your research study.

Because life insurance coverage costs are something you will likely pay monthly for years, discovering the policy that ideal fits your demands can conserve you an enormous amount of cash. It provides the firms we've found to be the best for different kinds of requirements, based on our research study of virtually 100 carriers.

Below are some of the most essential functions and defenses offered by life insurance plans. A lot of individuals utilize life insurance to supply cash to recipients that would suffer economic hardship upon the insured's fatality.

It might undergo inheritance tax, however that's why affluent people often get irreversible life insurance policy within a trust. The depend on helps them stay clear of estate tax obligations and preserve the worth of the estate for their successors. Tax obligation avoidance is a law-abiding strategy for lessening one's tax obligation responsibility and must not be perplexed with tax evasion, which is unlawful.

What is the difference between Riders and other options?

Married or not, if the fatality of one adult could imply that the other can no longer afford loan payments, upkeep, and taxes on the building, life insurance policy may be a great idea. One instance would be an involved pair who obtain a joint home mortgage to acquire their first house.

This assistance might also consist of direct economic support. Life insurance can help compensate the adult child's expenses when the parent passes away - Level term life insurance. Youthful grownups without dependents hardly ever require life insurance policy, but if a moms and dad will be on the hook for a youngster's financial debt after their death, the child might desire to bring enough life insurance policy to settle that financial obligation

A 20-something adult could get a plan also without having dependents if they expect to have them in the future. Stay-at-home spouses should have life insurance coverage as they contribute significant economic value based on the job they do in the home. A little life insurance plan can provide funds to honor a loved one's passing away.

How can I secure Flexible Premiums quickly?

This approach is called pension plan maximization. such as cancer cells, diabetic issues, or smoking. Note, however, that some insurers may reject protection for such people or cost very high prices. Each plan is special to the insured and insurance provider. It is essential to examine your policy record to understand what threats your policy covers, how much it will certainly pay your beneficiaries, and under what conditions.

That security matters, considered that your successors may not receive the fatality benefit up until numerous years right into the future. Investopedia has actually assessed ratings of firms that offer all various kinds of insurance coverage and ranked the ideal in many classifications. Life insurance policy can be a prudent economic device to hedge your bets and supply security for your loved ones in case you die while the plan is in force.

It's crucial to think about several elements prior to making a decision. What expenses could not be met if you passed away? If your partner has a high revenue and you do not have any children, perhaps it's not required. It is still necessary to think about the effect of your possible fatality on a partner and think about exactly how much monetary support they would need to regret without bothering with returning to work prior to they prepare.

If you're acquiring a policy on an additional member of the family's life, it is essential to ask: what are you attempting to insure? Kids and senior citizens truly don't have any meaningful revenue to change, however interment expenses may require to be covered in the occasion of their death. Furthermore, a moms and dad may intend to protect their youngster's future insurability by acquiring a moderate-sized policy while they are young.

What is the most popular Beneficiaries plan in 2024?

Term life insurance has both components, while permanent and entire life insurance policies likewise have a cash money value part. The survivor benefit or face worth is the amount of cash the insurance provider ensures to the recipients determined in the policy when the insured passes away. The guaranteed might be a moms and dad and the recipients may be their kids.

Premiums are the cash the policyholder pays for insurance policy.

Table of Contents

- – Who offers flexible Legacy Planning plans?

- – What should I look for in a Riders plan?

- – Is there a budget-friendly Beneficiaries option?

- – What does a basic Level Term Life Insurance p...

- – What is included in Legacy Planning coverage?

- – What is the difference between Flexible Prem...

- – How can I secure Wealth Transfer Plans quickly?

- – What is the difference between Riders and ot...

- – How can I secure Flexible Premiums quickly?

- – What is the most popular Beneficiaries plan ...

Latest Posts

What is Level Term Vs Decreasing Term Life Insurance? Key Points to Consider?

What is the Appeal of 20-year Level Term Life Insurance?

What is Term Life Insurance With Level Premiums? Learn the Basics?

More

Latest Posts

What is Level Term Vs Decreasing Term Life Insurance? Key Points to Consider?

What is the Appeal of 20-year Level Term Life Insurance?

What is Term Life Insurance With Level Premiums? Learn the Basics?