All Categories

Featured

Table of Contents

Term life insurance coverage is a type of policy that lasts a certain length of time, called the term. You pick the size of the policy term when you initially take out your life insurance coverage.

Pick your term and your amount of cover. Select the plan that's right for you., you recognize your premiums will certainly remain the same throughout the term of the policy.

Is 30-year Level Term Life Insurance worth it?

Life insurance covers most situations of fatality, however there will be some exemptions in the terms of the plan - Low cost level term life insurance.

After this, the policy ends and the surviving companion is no longer covered. Joint plans are typically extra inexpensive than solitary life insurance plans.

This safeguards the buying power of your cover amount against inflationLife cover is a wonderful thing to have since it gives financial security for your dependents if the worst happens and you pass away. Your enjoyed ones can likewise utilize your life insurance policy payment to pay for your funeral. Whatever they pick to do, it's terrific comfort for you.

Nevertheless, level term cover is wonderful for satisfying day-to-day living expenses such as home bills. You can likewise utilize your life insurance policy benefit to cover your interest-only mortgage, repayment home loan, institution charges or any type of various other financial debts or ongoing payments. On the various other hand, there are some disadvantages to level cover, compared to other sorts of life policy.

Why should I have Level Term Life Insurance Rates?

Words "level" in the expression "degree term insurance policy" suggests that this kind of insurance coverage has a fixed premium and face amount (death advantage) throughout the life of the policy. Basically, when people discuss term life insurance policy, they typically refer to level term life insurance policy. For the majority of individuals, it is the most basic and most cost effective option of all life insurance coverage types.

The word "term" right here describes an offered number of years throughout which the degree term life insurance policy stays energetic. Degree term life insurance policy is just one of the most popular life insurance policy policies that life insurance service providers supply to their clients because of its simpleness and affordability. It is likewise very easy to compare level term life insurance quotes and obtain the ideal premiums.

The system is as adheres to: To start with, choose a policy, death advantage quantity and plan duration (or term length). Select to pay on either a regular monthly or annual basis. If your early demise happens within the life of the plan, your life insurance provider will certainly pay a round figure of death advantage to your established recipients.

What is a simple explanation of Level Term Life Insurance For Seniors?

Your degree term life insurance coverage plan ends once you come to the end of your plan's term. Now, you have the complying with options: Alternative A: Keep uninsured. This choice fits you when you can insure by yourself and when you have no financial obligations or dependents. Choice B: Buy a brand-new degree term life insurance policy plan.

Your present internet browser might restrict that experience. You may be using an old browser that's in need of support, or setups within your internet browser that are not suitable with our website.

Best Level Term Life Insurance

Currently making use of an upgraded internet browser and still having trouble? Please provide us a phone call at for more aid. Your current internet browser: Identifying ...

If the plan expires before your death or you live beyond the policy term, there is no payout. You might have the ability to renew a term plan at expiry, yet the costs will be recalculated based upon your age at the time of revival. Term life is generally the least pricey life insurance offered since it uses a survivor benefit for a limited time and doesn't have a money worth part like permanent insurance has.

As you can see, the exact same 30-year-old healthy and balanced man would pay approximately $282 a month. At 50, he would certainly pay $571. Whole Life Insurance Coverage Rates 30 $282 $247 40 $382 $352 50 $571 $498 60 $887 $782 Source: Quotacy. Quotes are for a $500,000 permanent life insurance coverage policy, for males and women in exceptional wellness.

Can I get Level Term Life Insurance Policy online?

That lowers the general risk to the insurance company compared to an irreversible life policy. The minimized danger is one aspect that allows insurers to bill reduced premiums. Rates of interest, the financials of the insurer, and state policies can also affect costs. In basic, business commonly supply better rates at the "breakpoint" coverage levels of $100,000, $250,000, $500,000, and $1,000,000.

Check our recommendations for the finest term life insurance policy plans when you are all set to acquire. Thirty-year-old George wants to protect his family members in the unlikely occasion of his early fatality. He gets a 10-year, $500,000 term life insurance coverage plan with a premium of $50 monthly. If George passes away within the 10-year term, the policy will pay George's recipient $500,000.

If he stays alive and renews the plan after one decade, the costs will certainly be greater than his first policy because they will be based on his existing age of 40 instead of 30. No medical exam level term life insurance. If George is detected with an incurable health problem throughout the first policy term, he possibly will not be eligible to renew the plan when it ends

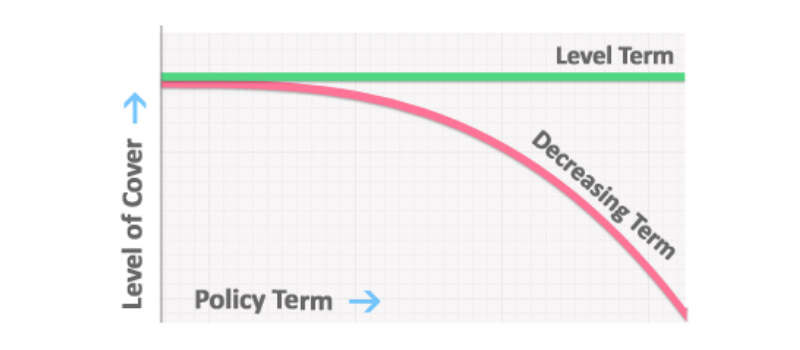

There are a number of sorts of term life insurance policy. The very best option will certainly depend upon your specific circumstances. Normally, the majority of business supply terms varying from 10 to 30 years, although a few offer 35- and 40-year terms. Level-premium insurance policy has a fixed monthly repayment for the life of the policy. Most term life insurance policy has a level costs, and it's the type we've been describing in most of this article.

How do I compare Level Term Life Insurance Premiums plans?

Thus, the premiums can come to be excessively costly as the insurance policy holder ages. They might be a good option for somebody that requires short-lived insurance policy. These plans have a fatality benefit that decreases annually according to an established schedule. The insurance policy holder pays a fixed, degree premium throughout of the plan.

Latest Posts

Instant Issue Term Life Insurance

Final Benefits Insurance

No Exam Instant Life Insurance